By Samantha Plesser

It is rare indeed when one of the most senior judges in the country and a sitting judge on the Federal District Court of Manhattan wrote that the way the prosecution of those directly involved in the financial crisis of 2008 was “distorted.” In the Opinion Pages of The New York Times on January 2014, Judge Jed Rakoff stated: “While officials of the Department of Justice have been more circumspect in describing the roots of the financial crisis than have the various commissions of inquiry and other government agencies, I have seen nothing to indicate their disagreement with the widespread conclusion that fraud at every level permeated the bubble in mortgage-backed securities.”

Judge Rakoff’s theory is one of prosecutorial weakness: the prosecutors are happy because they tell themselves that the threat of prosecution can still deter future crimes of this nature; it makes corporations happy because they avoid indictment; and happiest of all are the executives or former executives responsible for the misconduct who are left untouched to live another day.

Refusing to prosecute these powerful individuals was not always the American way. Most recently were the accounting frauds of the 1990s, vividly represented by Enron and WorldCom and their Chief Executive Officers Jeffrey Skillings and Bernie Ebbers. Although Ebbers and Skillings initially seemed untouchable, both are now in prison. Federal authorities indicted Ebbers with security fraud and conspiracy charges on March 2, 2004, the sentence was upheld, and he is serving his sentence as inmate #56022-054. His earliest possible release date is around July 2028; he will be 87 years old. Enron CEO Jeff Skillings is currently serving his 24-year prison sentence in Texas, however in June 2013, his sentence was reduced by ten years. He will likely be a free man by 2017.

The Savings and Loan Crisis of the 1980s resulted in the successful criminal prosecution of more than 800 individuals, including Charles Keating, the infamous owner of Lincoln Savings and Loan. The collapse of Lincoln Savings and Loan cost the federal government approximately $3 billion and defrauded over 23,000 investors, many of whom lost their life savings. Reflecting upon the 1980s Savings and Loan Crisis and the 2008 financial crisis calls to mind the great Yogi Berra—“its déjà vu all over again.”

Yet, the 1980 debacle had an added dramatic component that the 2008 crisis lacked — the direct involvement of five United States Senators accused of corruption by the Senate Ethics Committee because of their direct involvement with Savings and Loan and their close personal relationship with its owner, Charles Keating. The Senate Ethics Committee investigated all the five senators, who had little in common with each other except their friendship with Keating and the fact that Keating contributed massive sums of money to each of their campaigns. Keating’s ties to senators and large-scale campaign contributions couldn’t save him from 73 counts of fraud and four years in prison, plus paying restitution of $1.1 billion dollars to those whose money he had stolen. It seems that at one point, having friends in high places wasn’t enough to save you from your misdeeds.

The Great Crash of 1929 also delivered punishment to the responsible bankers who caused the crash. In fact, some might say the government was overzealous in punishing bankers that had nothing to do at all with the Crash. President Franklin Roosevelt specifically ordered bankers to be put on trial using the Pecora Committee. Even more importantly, the legislature signed into law the most stringent anti- business legislation ever created, including The Glass-Steagall Act, which protected depositors from having their savings comingled with bank investments, The Securities Act of 1933, which set penalties for filing false information about stock offerings, and the Securities Exchange Act of 1934, which created the Securities and Exchange Commission (SEC) to regulate the stock exchanges. Even today, courts and attorneys seek creative ways to maneuver around protective legislation passed in three to four days.

Attorney Ferdinand Pecora put every investment banker with a nickel to to his name on the witness stand during the Pecora Committee, including Charles Edwin Mitchell, president of the National City Bank (now Citibank), Hugh Baker, president of National City Co., and Samuel Insull, the utilities magnate. After only a few hours of questioning, Attorney Pecora forced the resignation of both Mr. Mitchell and Mr. Baker; Mr. Insull fled the country, only to be brought back later for trial. Further, Attorney Pecora was able to forcibly question J.P. Morgan Jr. in open court with the public watching his humiliation.

Many of these bankers, like Mr. Mitchell, were not guilty of breaking any laws period. They simply wanted to avoid further questioning, further publicity, and keep their companies intact. Therefore, they resigned their executive roles, rather than further sully their name and their company’s image. Imagine this scenario: Joe Cassano from AIG, Stan O’Neal from Merrill Lynch, or Dick Fuld from Lehman Brothers, whom we now know were aware of their respective institutions’ wrongdoings — the wrongdoings that caused the 2008 financial meltdown — “taking one for the team” and resigning from their positions so the general public, and their companies, could be saved. It would never happen. We would never expect it to.

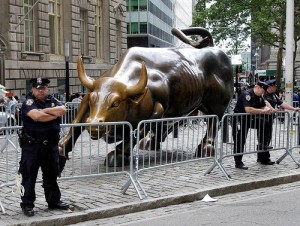

Would prosecuting the CEOs of these modern Goliath institutions have made a difference? Is accountability a value that we hold dear anymore? Judge Rakoff, who has seen more securities cases than any judge in this country, believes it illegal that not one individual was held accountable for the actions that ground the global economy to a halt and bankrupted the rich and the poor alike. He concluded his opinion with the following thought: “It is true that prosecutors have brought criminal charges against companies for well over a hundred years, but until relatively recently, such prosecutions were the exception, and prosecutions of companies without prosecutions of their managerial agents were even rarer.” In other words, financial institutions today and those that are at the top of the letterhead are simply above the law. It seems, even with evidence that points the finger directly at these men and women, the best we can manage is a slap on the wrist.

However, if it is true that “what goes around comes around,” history will one day repeat itself. The ancient cities have all fallen-they are dust, unable to sustain such power over so many, and although they had so much, they were greedy. Egypt, Greece, Rome: gone. Perhaps there is a lesson in there somewhere.

Samantha Plesser, J.D., is a graduate student studying non-profit management at The New School.